Investing

I believe that I have been fortunate to live in a great country in a great time in history characterized by growth.

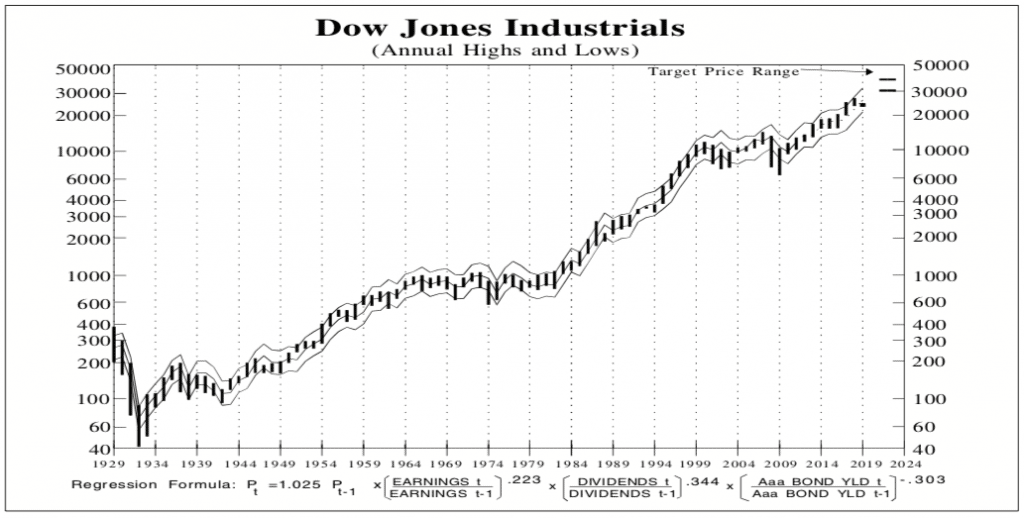

The proof of that seems to me to be in the economic growth as represented by the price of the Dow Jones Industrial Average (DJIA) equity since 1929.

The graph is courtesy of Value Line, an investment advisory service that I have subscribed to since 1978 and my parents since 1958.

The graph is a plot of the high and low price of the DJIA equity by year shown an equal % change (logarithmic) scale. There are probably better measures of the stock market equity prices but this has been in existence for a long time and it is basically indicative.

I was born in 1937 when the market average was 166. In 2024, 87 years later, the average is 41,000, a 250 times multiple, or an increase of over 6% per year.

Granted that there have been some significant variation by year and that the dollar does not have the same value now as over 80 years ago. But the trends are either flat or up.

Downturns are short in duration

Conclusion: Equities provide an opportunity for anyone to obtain economic growth on a longer term basis.

Growth: I believe that the growth is a result of breakthroughs driven by competition that in turn result in making capabilities available to a wider group of people who in turn create more breakthroughs.

Here are some significant growth producing breakthroughs: